In the years since COVID changed the world as we know it, hospital solution providers have scrambled to adapt to their clients’ new reality. A hopeful outlook for 2022 was met with tremendous labor and inflationary challenges, while RSV, flu, and persistent COVID mutations hampered efforts to get back to normal. With three years of data now collected, it’s clear that the bounce back from COVID remains a slog, and successful sellers are finding new ways to move forward.

The American Hospital Association is pleased to share the results of its third annual survey on the state of hospital and business partner relationships. Becoming a Health Care Business Partner of Choice polled 400 health care solution providers to find out which trends were resonating in sales and marketing.

Budgets Increase; Decisions Slowed

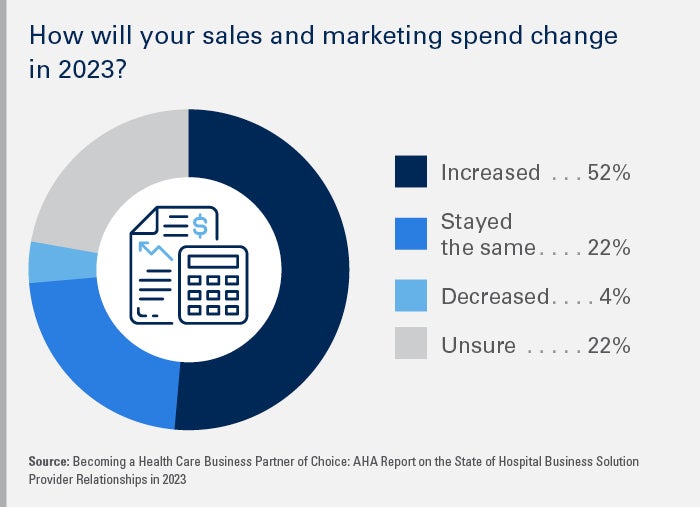

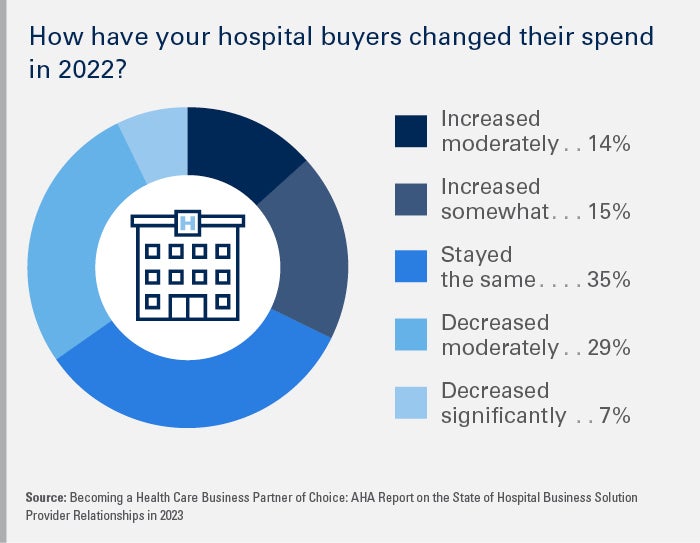

For the second year in a row, over 51% of respondents said they will be increasing their sales and marketing spends for 2023, and an additional 22% said their budgets will stay the same. Similar to last year, about 35% of hospital solution providers reported their buyers kept their expenditures the same, while another 29% saw a moderate decrease.

These budget numbers may reflect a concern that hospital decision-makers face pressures on multiple fronts. When asked about their biggest sales and marketing challenges, respondents overwhelmingly indicated that reaching their target audience and connecting to busy hospital executives, followed by the difficulty to build relationships without face-to-face interactions, characterized the year. Unsurprisingly, about 82% said hospital decision-making has slowed down or stayed the same compared to last year.

In-Person Is Back

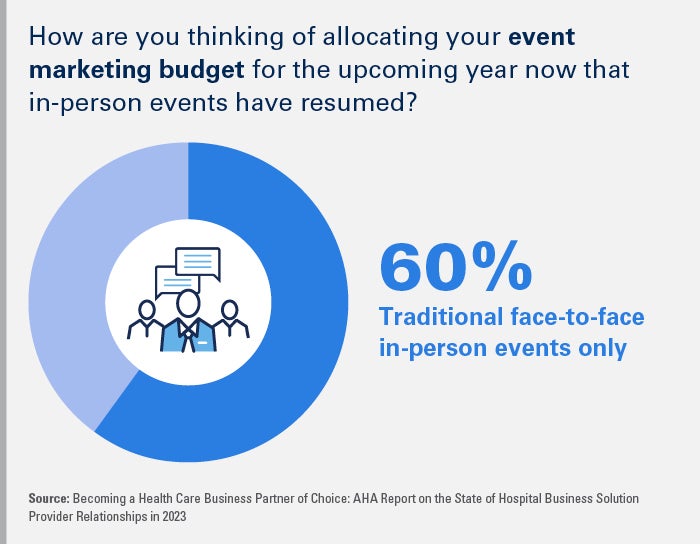

This year’s survey results indicate that in-person conferences and trade shows have roared back to life. Nearly 70% of respondents said they were making investments in conferences and trade shows to reach prospects beyond the computer screen. Second only to direct contact, these in-person events ranked as an extremely effective method for reaching hospital buyers. Virtual events have been put on the back burner, with more than half of respondents saying they would be designating their event budget towards in-person events only.

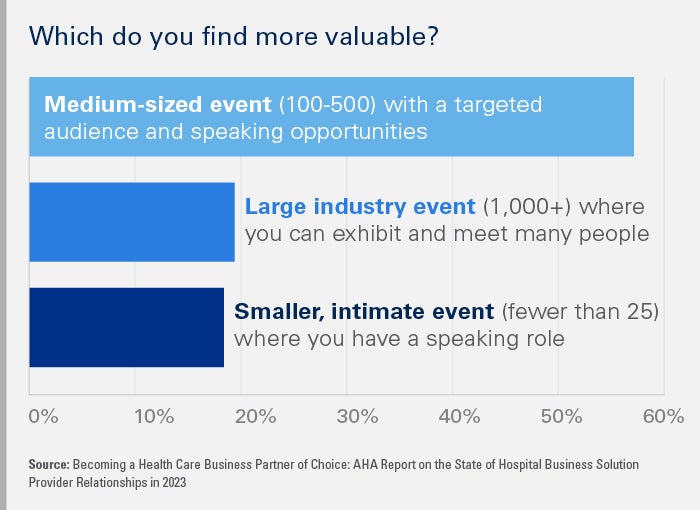

It's clear there is an appetite for in-person engagement, but the survey was also clear about which kind of face-to-face opportunities carry the most perceived value. When given a choice among industry event sizes, respondents said medium-sized events (about 100-500 attendees) with opportunities to speak were vastly preferred over their small (under 100) and large (1000+) counterparts.

"In-person events offer opportunities for impromptu conversations and discussions about the content being shared that can create new connections and deepen existing relationships in ways that can’t happen in a virtual setting. That’s why we make sure our in-person events offer a variety of ways to share lessons, exchange ideas and explore new solutions," says Julie Doyle, AHA Vice President of Marketing.

Workforce Challenges Remain

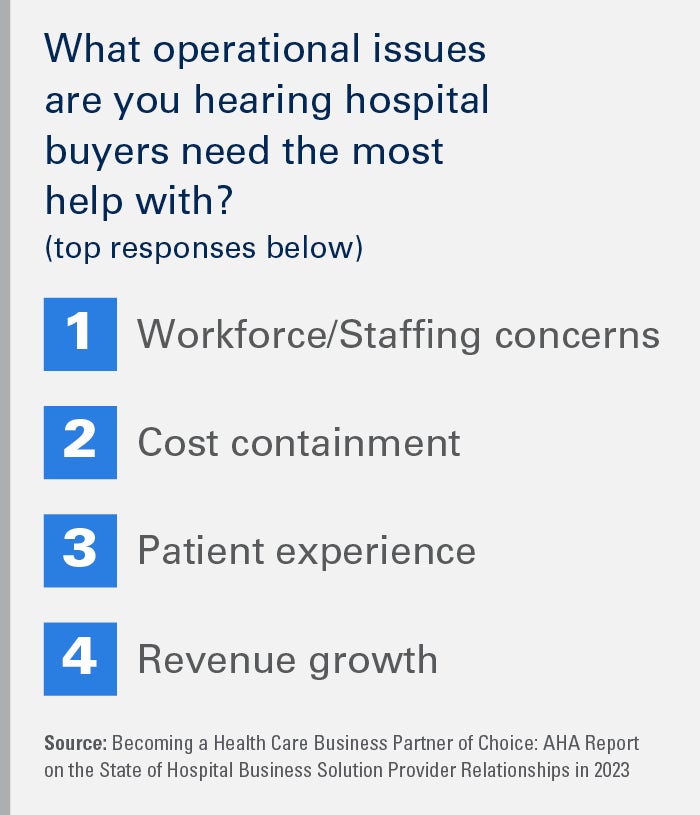

Health care solution providers are clearly seeing the impact of the financial pressures their clients are experiencing. Operating expenses have spiked, especially for labor, supplies and prescription drugs. In fact, analysis shows that somewhere between 50-68% of hospitals will conclude 2022 with negative operating margins. Survey respondents report that containing costs and workforce/staffing concerns were the top operational sticking points for their customers. The market insight is that winning solutions should be both cost effective, leveraging existing infrastructure where possible, and easy to implement, given staffing concerns.

When asked about which issues and challenges they are aligning their solutions with, survey respondents chose “improving consumer experience” and “quality and patient safety” most often, followed closely by “workforce.” Clearly, health care solution providers recognize the value of positioning offerings to match the broader issues hospitals and health systems have identified as top challenges.

Other Findings

- Are ads dead? Digital and print ads were seen as the least effective marketing tools in the sales arsenal.

- For another year, educational content marketing and thought leadership were flagged as crucial in selling a solution. Some respondents even mentioned offering continuing education courses for their clients. “Educational content and thought leadership remain an area of growth,” says Kathleen Wessel, AHA Vice President of Business Management & Operations. “Hospitals and health systems seem to be putting a priority on case studies and ease of implementation when deciding if a solution will work for them.” The survey also revealed that solution providers are also investing in training for their sales teams to help them keep pace with the evolving health care landscape and understand the challenges hospitals and health systems face.

- New partnerships with health care providers, health care trade associations and other solution providers remain desirable, according to survey respondents. Could the uptick in interest in conferences act as a bridge to not only buyers, but also between potential partners that have similar goals?

Connect with us

Want to partner? Let's talk.

Whether you're looking for business partner opportunities, hospital solutions, or just want to let us know how we did, you can contact us. Please provide the following information: