Hopeful & Hybrid. These two words summarize the outlook of many businesses looking to partner and sell to health care organizations in 2022. Rising vaccination rates and proven public health measures bring a renewed sense of opportunity, albeit in a challenging and changing landscape.

For the second year in a row, the American Hospital Association shares the results of its Becoming a Health Care Business Partner of Choice survey results. We received responses from over 400 health care solution providers across the nation to get a better sense of the buyer-seller dynamic and to monitor future trends.

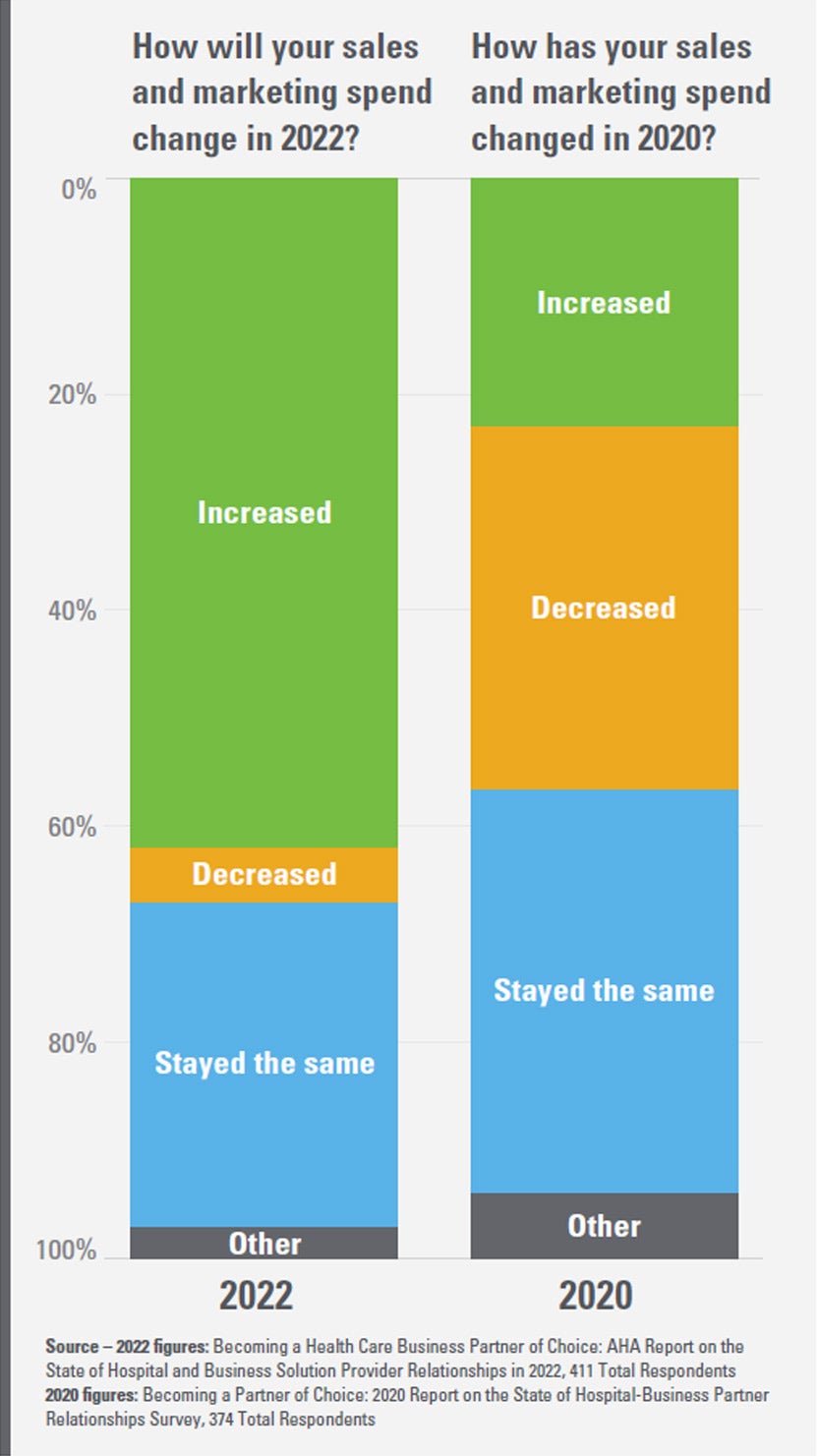

Optimism for 2022 reflected in sales and marketing spending

Most respondents expressed optimism for 2022. A full 62% of respondents said they will increase their sales and marketing expenditures next year, compared with 70% who saw that number stay the same or go down as reported in late 2020. They are hoping for a complementary outlook from the hospital buyer: over 36% saw an increase in spending in 2021. That’s quite a reversal from last year when just over half of respondents reported seeing a decrease in spending among their buyers.

“The unprecedented speed and scope of the COVID-19 pandemic forced hospitals and health systems to address many unexpected challenges. As the field navigates this tremendous time of change, health care leaders are reflecting on decisions that worked and those that didn’t and about what capabilities they will need to succeed in today’s pandemic-impacted environment as they work to improve care delivery, operational processes and build new business models.

- Kathleen Wessel, AHA Vice President of Business Management & Operations

Hospital operational priorities shift to workforce concerns

An analysis by the AHA released in February 2021 showed that the one-two punch of COVID-19 expenditures and a steep decline in non-COVID-19 patient volume led to billions in lost revenue. Survey responses from 2020 and 2021 both ranked financial performance as a top operational priority for hospitals. The biggest jump, however, was in workforce concerns. As the AHA has previously reported, the pandemic has taken a heavy toll on front line health care workers, and nearly 60% of respondents agreed that this was a key operational issue.

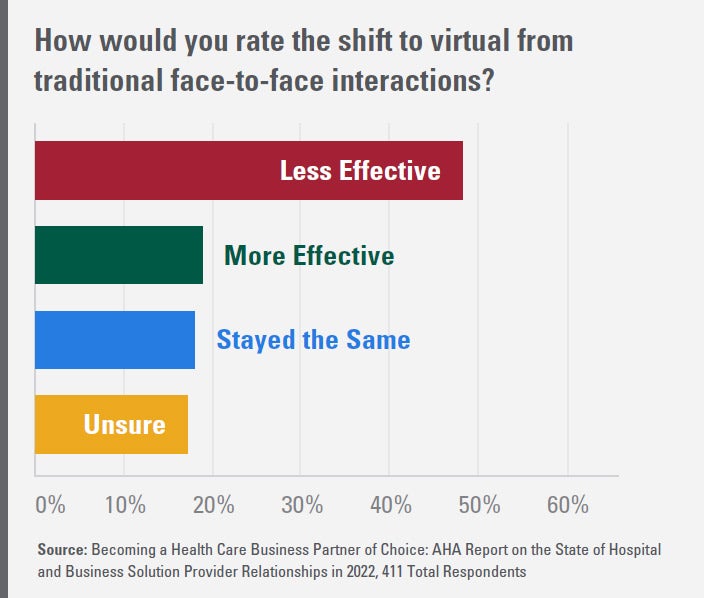

A hybrid approach to interactions emerges

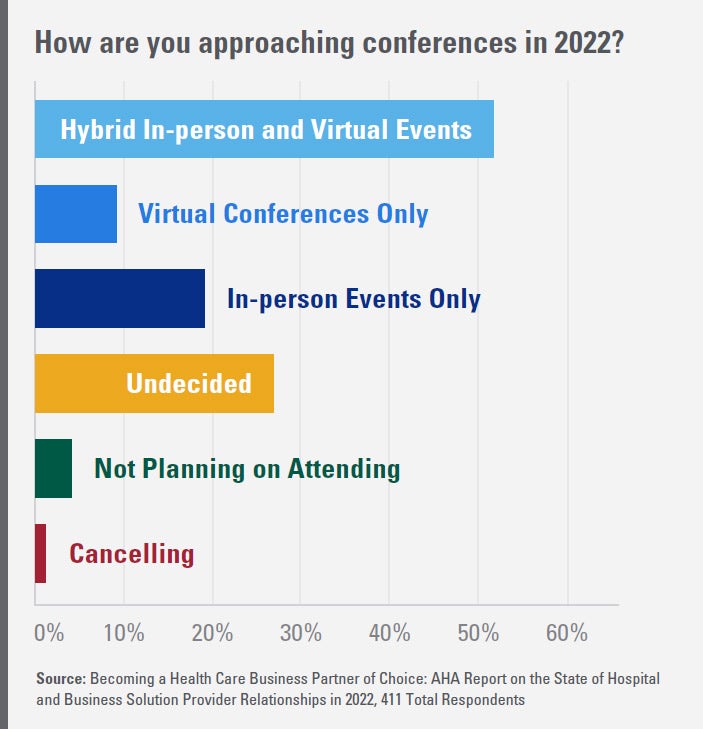

Questions loom large on the balance between digital and in-person interactions on buying. When asked about the move to a more digital landscape in 2020, many said it was too early to tell how this would impact their sales strategies. In 2021, the verdict leaned negative: nearly 48% said virtual interactions were less effective than face-to-face ones. As the selling dynamic shifts, a hybrid in-person/virtual model is emerging strong. Forbes predicts that the move to hybrid events is part of the “new normal.”

Respondents said virtual conferences and webinars were the most utilized substitutions for in-person conferences. Despite their lower satisfaction with digital platforms, over 50% said they would be taking a hybrid approach to conferences in 2022.

“One advantage to digital events is providing new forums for vendors to engage with busy executives, specifically in those intimate, easy-to-access forums.”

- Sarah Reusch, AHA Marketing Manager for Live Events

AHA survey respondents agreed: 65% said they find the most value in smaller industry events with a speaking role.

Other survey takeaways

Decision-making

Respondents reported decision-making has slowed down since the start of the pandemic (though less so in 2021 vs 2020), while leveraging trusted relationships and demonstrating strong ROI are the most resonant value points for hospital buyers.

Reaching their target audience/customer

Is the most pressing sales and marketing challenge for over 60% of health care solution providers surveyed.

Education wins again.

Fifty four percent of respondents indicated “providing more education tools and resources” as the top sales strategy that will continue beyond the pandemic. Expanding educational content landed in the top 5 investments that sellers are making to reach their prospects and customers. Respondents continue to see these educational resources as powerful ways to partner with both health care providers and, interestingly, fellow solution providers, to get a foot in the door.

52% of respondents say that forming new partnerships

Not just with customers, but also with other health care solution providers and with health care industry trade groups — is another key component of their sales and marketing strategy, underscoring the trend toward building a health care ecosystem.

Will you be positioned for success in this brave, new, at-least-partly-virtual world?

The American Hospital Association is the field’s trusted resource. Leaders look to the AHA for the latest trends, information, and resources to achieve better health outcomes across America.

Discover how easy it is to partner and grow with the American Hospital Association.

Connect with us

Want to partner? Let's talk.

Whether you're looking for business partner opportunities, hospital solutions, or just want to let us know how we did, you can contact us. Please provide the following information: